Are you a small business owner looking for a Xero alternative for all your accounting needs?

Xero certainly is a popular choice. However, there may be better fits for some teams.

And with the overwhelming amount of accounting software on the web, choosing the right one for your business can be overwhelming!

In this blog post, I will explore the 5 best Xero alternatives for small businesses in 2023.

We’ve done all the hard work for you and researched various accounting software options so you can decide for yourself.

Is there other accounting software out there better than Xero?

Our list includes user-friendly, affordable, and scalable software, so no matter your business size or type, you’ll find something that catches your eye.

I’m going to break down the user-friendliness, key features, pricing, and reviews of each software to find out what comes out on top.

Whether you are looking for a cloud-based solution, more advanced reporting capabilities, or software that integrates with other business tools, we have got you covered.

Say goodbye to boring spreadsheets and hello to a more exciting way to manage your finances.

Keep reading to discover which Xero alternatives made our list, and prepare to make accounting fun again!

What is Xero?

Since you clicked on this article, you most likely already know what Xero is, so I’m just going to give you a brief run-down.

Essentially, Xero is an accounting software that helps you manage your finances, track expenses, and send invoices to your clients.

Xero is a cloud-based software, meaning you can access it anywhere in the world at anytime!

Known for its wide range of integrations, automation capabilities, and easy-to-use interface, it’s no wonder it’s quickly become a leader in cloud accounting software.

However, is Xero really the best option out there for you?

Let’s introduce my top 5 Xero accounting competitors and determine if any of these alternatives can beat the powerhouse that is Xero.

Want to find out more about Xero? Check out our how to use Xero tutorial.

Top 5 Best Xero Alternatives for Small Business

Xero vs QuickBooks

First up on our list is QuickBooks.

QuickBooks is another popular accounting software that helps business owners create financial reports, pay invoices and manage their taxes, income, and expenses.

Sounds pretty similar to Xero, right?

The main difference between Xero vs QuickBooks is that QuickBooks offers a more traditional desktop version called QuickBooks Desktop (installed on your computer).

This means you don’t need an internet connection to use it, plus it can handle larger amounts of data more efficiently than the online version.

However, for the rest of this Xero vs QuickBooks review, I’m going to focus on QuickBooks Online.

So with that said, let’s get started.

User-friendliness:

According to SoftwarePundit, QuickBooks is slightly more complex and better for people with accounting knowledge.

However, Cloudwards review says you can do more with QuickBooks, and sometimes it’s more efficient than Xero.

In my opinion, Xero’s sleek and minimalist design and customizable dashboard is better for complete newbies with no accounting knowledge.

Generally speaking, there’s not much between the two, but QuickBooks has been known to have a slightly higher learning curve than Xero.

Pricing:

- Simple start: $17 a month (1 user plus your accountant)

- Essentials: $26 a month (3 users plus your accountant)

- Plus: $36 a month (5 users plus your accountant)

- Advanced: $200 a month (25 users plus your accountant)

QuickBooks offers discounts for the first 6 months, at just $1 a month for the first 3 plans, and a 50% discount for the advanced plan.

Additionally, they have a 30-day free trial on all plans.

Xero’s plans are slightly more expensive, from $25 on the ‘Starter’ plan to $54 monthly on the ‘Premium’ plan.

They also offer a 30-day trial for any plan.

Although more expensive, you can have unlimited users with Xero – whereas QuickBooks caps at 25 users on their most expensive plan. Therefore, Xero wins!

Key features:

Both platforms offer key accounting and reconciliation features – but which does it better?

Bank reconciliation:

- With QuickBooks, simply enter the ending bank balance, then manually mark transactions that have cleared your bank to reconcile a bank account.

- Additionally, you can upload a file of your transactions.

Invoicing:

- The customization options within QuickBooks are better than Xero. For example, you can choose between different Invoice templates and colors.

- Additionally, QuickBooks can automatically calculate sales tax rates based on the customer’s address.

- QuickBooks also has unlimited invoice capabilities on all plans, whereas Xero’s lower plan limits the number of invoices you can send.

Accounts Payable:

- Both excel in this department; however, QuickBooks can generate recurring payments.

- Xero doesn’t allow you to create a recurring payment – only the bill.

Inventory management:

- Both platforms are pretty much on par with inventory management. However, inventory management is included in all of Xero’s plans.

- You’ll only receive inventory management as a feature on the top 2 paid plans within QuickBooks.

Integrations:

Both software offers many integrations with other platforms, with Xero closing in on a couple hundred more than QuickBooks, including favorite platforms and tools such as HubSpot, MailChimp, and more.

Customer support:

QuickBooks offers far superior customer support than Xero, offering both phone support and live chat.

With Xero, you can only reach out via email or chatbot (in addition to their support guides and articles on their website).

Xero vs Sage

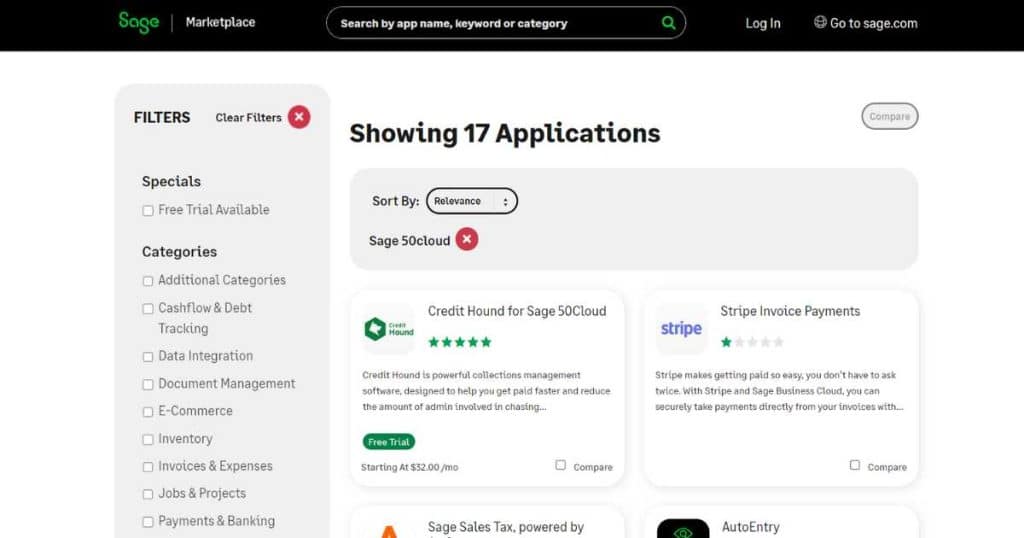

The following software that’s made the cut for our 5 best Xero alternatives for small businesses is Sage.

Sage Accounting is a hybrid desktop and cloud-based accounting software with essential bookkeeping and accounting features.

Sage makes your life easier by automating invoicing, expense tracking, and bank reconciliation tasks.

They also offer multiple accounting, HR, and CRM products, all fit for small to medium-sized businesses.

Additionally, there are quite a few different accounting plans, which makes selecting a plan quite confusing.

Unless you’re a construction or real estate company, we suggest using Sage Accounting or Sage 50cloud.

These are both designed with small businesses in mind but offer different things for small business owners or freelancers.

Born in 1981, Sage has a few years under its belt compared with Xero. But does experience trump what Xero has to offer? Let’s find out.

User-friendliness:

Sage provides a more traditional accounting software interface, which some users may find more familiar and comfortable.

However, on the other hand, Sage has been known to have a steeper learning curve.

I’d recommend Xero again if you’re entirely new to accounting, as the interface is slightly easier to navigate.

Also, the number of products they offer can overwhelm some users (you’re not alone, it confused me at first).

Therefore the choice really comes down to you!

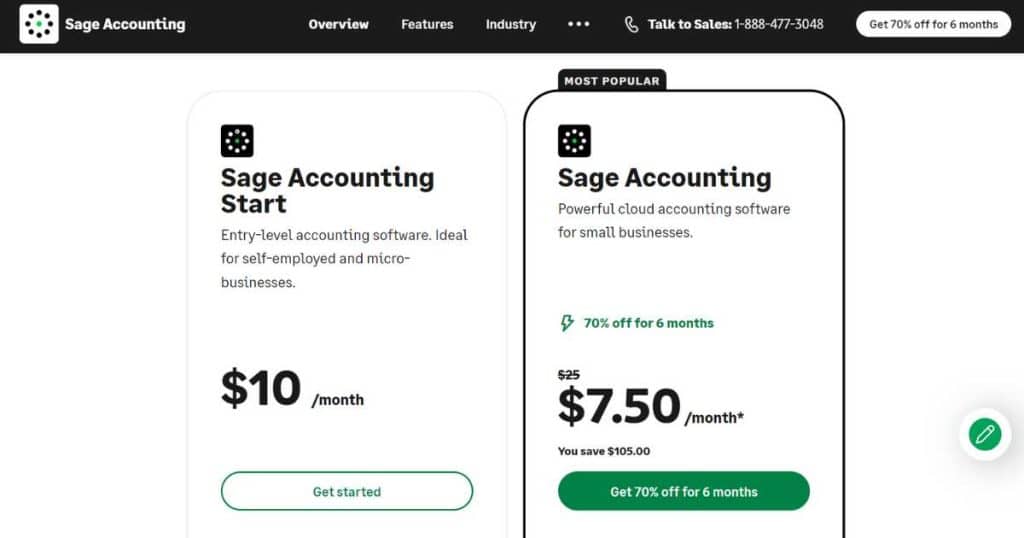

Pricing:

- Sage Accounting start: $10 per month.

- Accounting: $25 per month.

Additionally, you receive a whopping 70% discount for the first 6 months when you sign-up for the Sage Accounting plan.

If you want more extensive features, I suggest you look at the pricier Sage 50cloud pricing plans and what they have to offer.

With that said, what key features does the Sage Accounting plan offer for small business owners?

Does it stack up to Xero, or do you have to upgrade to Sage50 to reap the benefits you get with Xero?

Key features:

Expense and transaction tracking:

- Xero uses live bank feeds to track incoming and outgoing money within your accounts. You also have the option to input this information manually.

- With Xero, you can sort all of your new transactions using a ‘Smart categorization’ feature.

- With Sage, you can connect bank feeds but can’t set up rules, and there’s no categorization feature.

Reporting:

- Sage Accounting offers basic reports, including profit and loss reports, balanced sheet reports, and cash flow statements.

- Sage 50cloud offers more advanced reports that can report things like job costs or inventory.

Invoicing:

- Sage only has one invoice template, whereas Xero offers many customization options!

- Also, you can send invoices directly from the mobile app within Xero and Sage, and automate your invoice processes.

Inventory management:

- While inventory management is limited on the Sage Accounting plans, you can still set up your products or stock. Also, you can create inventory reports and receive warnings if you’re low in stock.

- Additionally, Sage 50cloud offers even more advanced inventory management tools and features if you decide to go with that product!

Customer support:

If you’re after support, Sage has you covered! Simply head over to their support page on their website, where you’ll find resources relating to your questions.

Additionally, they offer a community page called Sagecity, where you can contact others in your region.

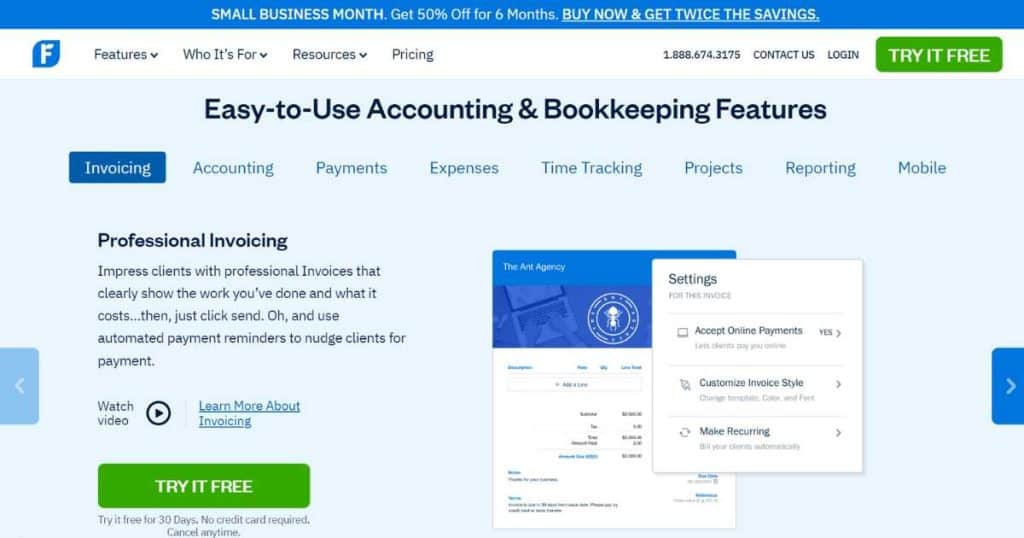

Xero vs FreshBooks

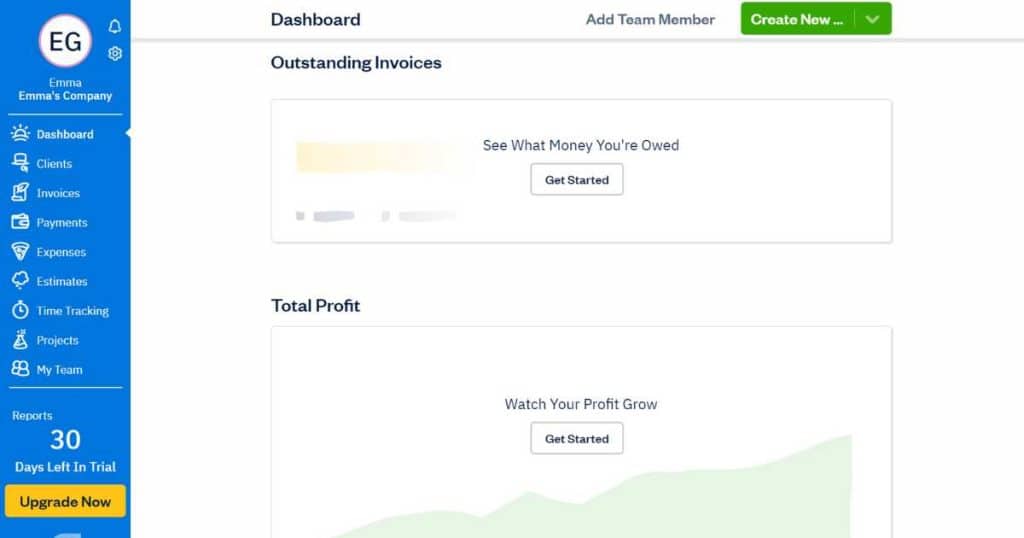

FreshBooks is our next cloud-based Xero alternative, ideal for freelancers, independent contractors, and small teams.

They combine accounting tools with project and team management features such as time tracking and file sharing.

This completely eliminates the need for individuals or teams to invest in project management software!

But how does it compare to Xero? Let’s find out.

User-friendliness:

We’ve previously mentioned how easy and clean Xero is to use. And so far, nothing has quite topped Xero in this department.

What if I told you FreshBooks is easier to use than Xero? That’s right! Their interface is super straightforward to set up.

You can even seamlessly transfer any information from another platform to get you up and running quicker.

When we say this software is made for beginners, we mean it!

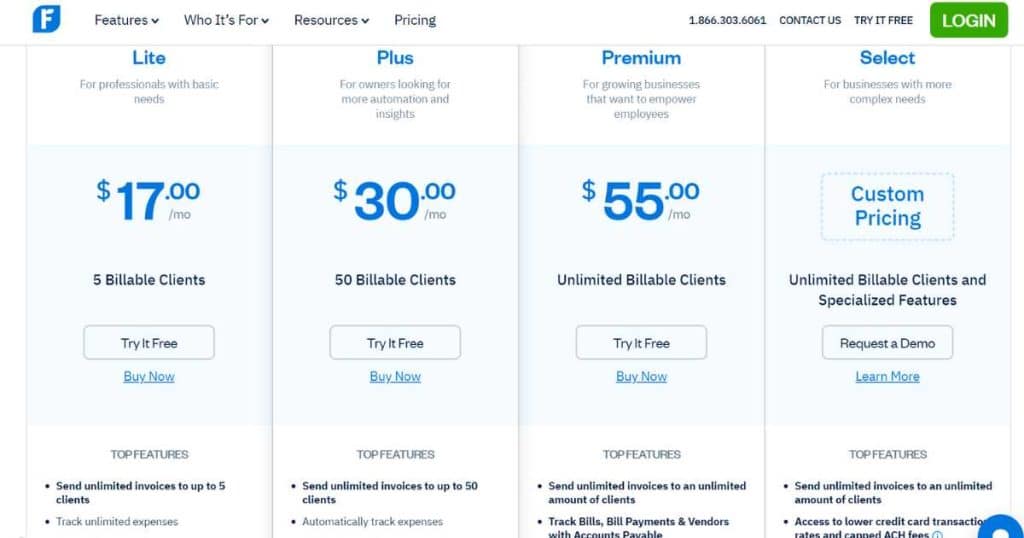

Pricing:

- Lite: $17 per month (1 user)

- Plus: $30 per month (1 user)

- Premium: $55 per month (1 user)

- Select: Custom pricing

In terms of users, you can pay an additional $11 for any extra users you want to add to your account.

They also offer a 60% discount for your first 6 months and a free 30-day trial for all plans.

FreshBooks is a lot cheaper than Xero if there’s only you. However, you can see how pricey the plans can be if you have many team members.

That’s part of the reason why this software is best suited for freelancers or individuals.

Key features:

Invoicing:

- Similarily to Xero, you can create and send new and recurring invoices, customize your invoices and manage your customer account.

- Additionally, another bonus (that seems to be a returning theme with these Xero alternatives) is that you can create unlimited invoices on all plans.

Accounts payable:

- FreshBooks may be basic regarding Accounts payable tools, but don’t let that fool you! As a freelancer, you’ll have everything you need to stay on top of your expenses, from creating vendors and bills to managing recurring expenses and recording payments.

- The only drawback is this feature is only available on the higher-paid plans.

- As a full accounting software, I’m hardly surprised that Xero’s features are more advanced.

Time tracking:

- With unlimited time tracking on all plans (and their mobile app), FreshBooks acts as both an accounting and basic project and team management software for freelancers.

- Xero offers this feature but as an add-on. Also, there’s a cost attached to it ($7 for one user per month and $5 for every user after that per month). This can get expensive depending on the size of your team; however, completely unnecessary if you already use a project management software with this function.

Reports:

- If you’re after basic and easy-to-use reports, FreshBooks is sufficient. However, you’ll be disappointed if you really want to crack down on important details through advanced reporting.

Bank reconciliation:

- There is no bank reconciliation capability on the lower-tiered plan

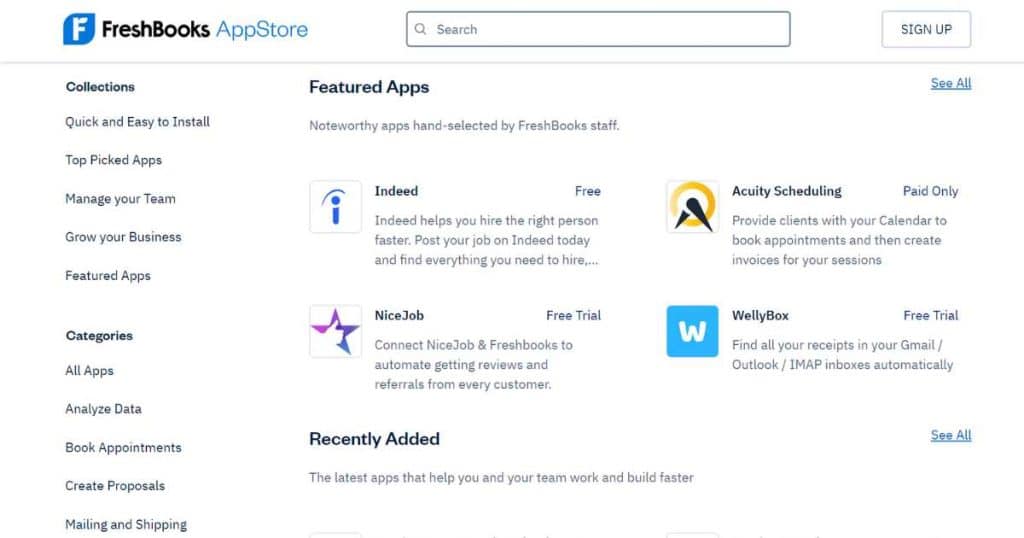

Integrations:

FreshBooks offers over 100 integrations through their app store, including the ability to connect with Zapier and others to help you streamline your business processes.

This is good but doesn’t compare with Xero’s integration capabilities.

Customer support:

FreshBooks customer support is excellent. They offer phone, chatbot, and email support, how-to guides, and other resources.

Customer reviews on G2 state that their customer service is pretty good overall, and they love that you can talk to an actual person!

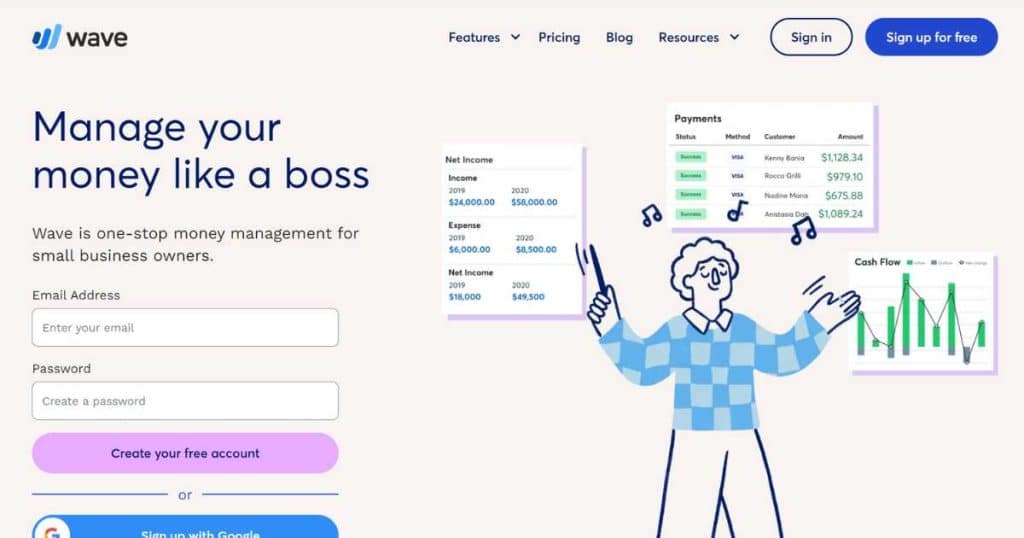

Xero vs Wave

Wave is another cloud-based Xero alternative best for a small service-based business, freelancers, or entrepreneurs on a tight budget.

You can do all the basic accounting functions on Wave, including invoicing, expense tracking, payroll, and basic reporting all for FREE!

That’s right – Wave is completely free to use!

If you’re after accounting software without a hefty price tag or complex features such as inventory or fixed assets, Wave might be your best option.

Comparing Xero vs Wave is difficult as Xero simply offers more.

Therefore, I will focus on what this free accounting software does offer!

User-friendliness:

- Considering Wave doesn’t offer any complex features, you’d expect the learning curve to be shallow and the interface sleek and easy to use. And Wave doesn’t disappoint!

- One user describes Wave as a 10/10 on TrustRadius, and the general consensus amongst other online reviews is similar.

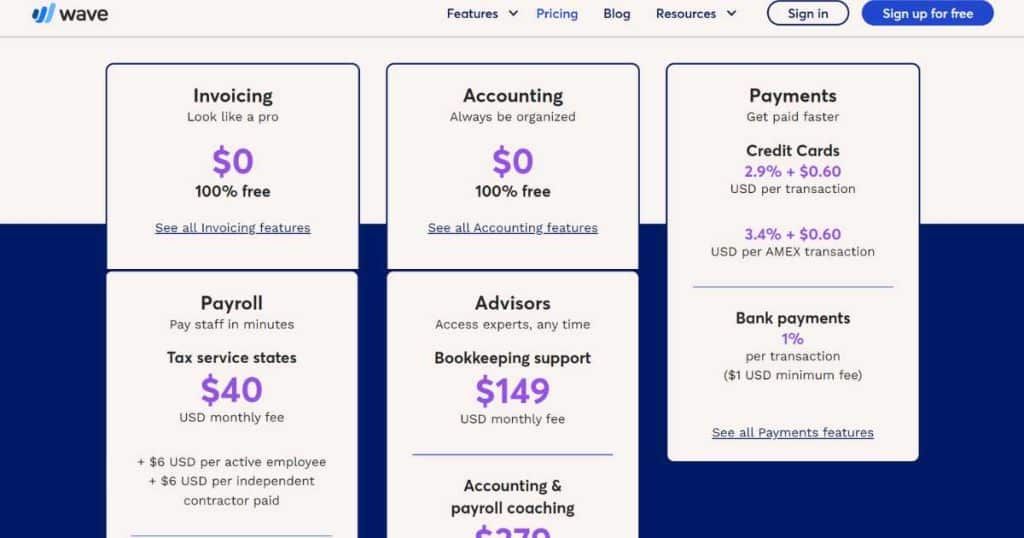

Pricing:

- Wave Invoicing: Free

- Wave Accounting: Free

The only things you’ll pay for on Wave are Credit card and bank processing fees and Payroll services (which are all optional, depending on your needs).

Their free plans include unlimited invoices, billable clients, and users.

You can’t really compare free plans with Xero’s paid plans.

However, I will say that with a free plan, what will you lose if you just give it a go? You never know; it might have everything you need.

Key features:

Invoicing:

- Wave actually doesn’t fall too short of Xero when it comes to Invoicing features! You can create recurring invoices, email invoices and track each payment through your customer accounts.

- The only thing to remember is the small payment processing fee with credit cards and bank payments.

Bank reconciliation:

- This feature is where you can tell Wave is a basic, free accounting software. You have to input your statement balance and the dates, then manually reconcile your transactions.

- However, in saying that, if you only have a few transactions, this isn’t too much trouble.

Accounts payable:

- With Wave, you can do all the basics you’d expect from an accounts payable system like recording expenses, viewing your unpaid bills and creating vendors. However, you can’t do anything fancy like view incurred expenses, write off half-paid invoices, or issue credit memos.

Reporting:

- You’ll find all basic account and financial reports like profit and loss, balance sheets, cash flow, or sales tax reports available within Wave. The customization and functionality within these reports are limited when compared with Xero, but they give you enough information!

Integrations:

You’ll have to integrate Wave directly with Zapier to connect any third-party apps, which can be difficult for people with little or no experience.

The only direct Wave integrations are internal, such as their Payroll or advisor service.

Customer Service:

Despite being a free accounting software, people still need support when things go wrong. And unfortunately, Wave only offers a mediocre chatbot service and basic resources within their help center. The lack of customer service really does let Wave down and is a common trend amongst these G2 online reviews.

However, as the platform is so simple to use (and free), I can understand why Wave doesn’t invest more money and time into complex support systems or detailed resource pages!

Check this quick guide on wave accounting software tutorial.

Xero vs Zoho Books

Zoho Books is another leading Zoho product that offers small businesses full-featured inventory, invoice management, banking, and other advanced accounting tools.

You’ll also receive additional features like automated workflows and project management tools!

If you already use Zoho CRM, Zoho Projects, or other Zoho products, it makes sense, in theory, to keep all your online tools under one roof, right?

Zoho Books is one of the top contenders in the accounting world, but how does it stack up compared with Xero?

User-friendliness:

As we mentioned, Zoho Books is a jam-packed online accounting software with many features (which we’ll dive into shortly).

However, because of this, it can be overwhelming for beginners with no accounting experience.

The initial setup doesn’t guide you through the total platform, so you have to figure out things like how to input operating balances on your own.

Overall, if you’re already familiar with Zoho’s other products, you’ll find Zoho Books interface a breeze to navigate through. Otherwise, the learning curve is steeper and interface more clunky than Xero’s sleek minimalist interface.

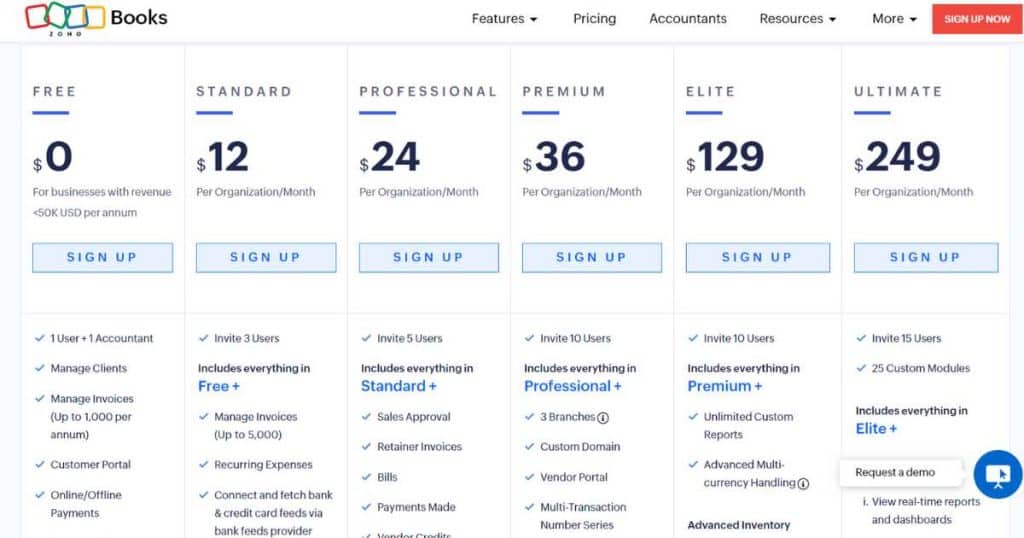

Pricing:

- Free: $0 (1 user)

- Standard: $12 per month (3 users)

- Professional: $24 per month (5 users)

- Premium: $36 per month (10 users)

- Elite: $129 per month (10 users)

- Ultimate: 249 per month (15 users)

Zoho Books also offers a 14-day trial on any plan, and the option to add additional users to any plan for $3 (per user, per month).

Xero doesn’t offer a free plan, so Zoho wins in that respect.

Although the free plan has all the basics to get you started, it has limitations with invoice limits per year and advanced features like time tracking and sales and purchase order management.

Additionally, the sheer number of plans they offer can be overwhelming! Xero keeps it simple with just 3 plans.

Key Features:

Invoicing:

- Zoho Books and Xero are fairly even regarding invoicing. You can do all the basic invoicing tasks like creating items, viewing invoices and balances, and more.

- However, the amount of options and templates you can choose from with Zoho Books is incredible. You can change the font, alignment, orientation, and more. With Xero, you simply can’t do as much (you can only edit the invoice line items).

- For businesses that want to create unique and professional invoices to match their brand, Zoho Books can make this happen for you!

Account Payable:

- Zoho Books Account Payable features offer everything you’d expect from an accounting software. Simply enter and manage your bills, expenses, or estimates. Additionally, you can easily manage your costs with purchase orders that can easily be turned into bills.

- Also, they offer customizable recurring payments and reminders.

- Most of these features are available on all plans.

Inventory Management:

- Both Xero and Zoho Books have the best Inventory management in the biz. In fact, I couldn’t find much to fault about either of the two.

- The only difference between the two is that Zoho Books has a specific inventory management software with more advanced inventory features. This is a different product within Zoho (but also offers a free plan).

Reporting:

- Zoho Books offers all your basic reports, plus detailed inventory, taxes, projects, and timesheet reports, similar to what Xero offers.

- If you upgrade to the paid plans, you’ll receive more report functionality and options, such as report tags and custom reports.

- Additionally, you can view your reports anywhere with Zoho’s mobile app.

Integrations:

As I previously mentioned, Zoho is an excellent choice for businesses already using other Zoho products.

But what about third-party app integrations? You’ll get some, including Zapier, Slack, GSuite, Microsoft365, Dropbox, and Google Drive. However, this doesn’t even close to the number of integrations Xero offers!

Customer Support:

If this review were written about Xero vs Zoho Books on customer support alone, Zoho Books would win in a heartbeat.

You get live customer support through both live phone and chat on their paid plans, and you can send them an email, and they’ll get back to you on the free plan.

The online ratings through the popular software review platform TrustRadius are pretty solid too, which you can check out here.

Also, you can access the Zoho help database and video tutorials and webinars, all available online.

Final Thoughts

Congratulations! You made it to the end of this top 5 Xero alternatives review in 2023.

While Xero is an obvious choice for small businesses, this guide has shown there are several great alternatives available!

And in our opinion, Zoho Books, Wave, Sage, FreshBooks, and QuickBooks all bring something different to the table.

Whether you’re looking for affordability, ease of use, or advanced reporting features, there’s an accounting software out there that can help you manage your finances effectively!

So why stick with the status quo? Explore these Xero alternatives, soak up all their free trials or plans, and find the one that’s right for you!